How is Australia Property Market Doing?

This chart pack released by Cotality provides a detailed analysis of Australian housing market trends up to September 2025. Here’s the overview to share with you all.1. Housing Value Performance: Momentum Continues to Strengthen

National Growth Accelerates:

Australian dwelling values rose 2.2% over the three months to September — the largest quarterly gain since May 2024. Annual growth strengthened for the fourth consecutive month, reaching 4.8% over the year to September.

Regional Differences:

Capital city values rose 2.3%, slightly outpacing regional areas (1.8%).

Top-Performing Cities:

Darwin led all capitals with a 5.9% quarterly increase, followed by Perth (4.0%) and Brisbane (3.5%).

Annually, Darwin, Perth, and Adelaide recorded strong gains of 12.9%, 7.5%, and 6.2%, respectively.

Major Market Trends:

Quarterly gains were 2.1% in Sydney and 1.0% in Melbourne.

Prices in Sydney, Brisbane, Adelaide, Perth, and Darwin are now at record highs.

Value Segmentation:

The mid-tier segment (homes valued between AUD 648,000 and 1.2 million nationally) recorded the strongest quarterly rise, up 2.5%.2. Sales Activity and Tight Supply Conditions

Major MarkSales Volumes:

In the 12 months to September, 540,775 dwellings were sold nationally.

Annual sales activity in capital cities was roughly flat (+0.8%) compared to last year, but with strong variations across cities — Darwin (+60.1%) and Canberra (+12.0%) surged, while Sydney, Brisbane, and Perth saw declines.

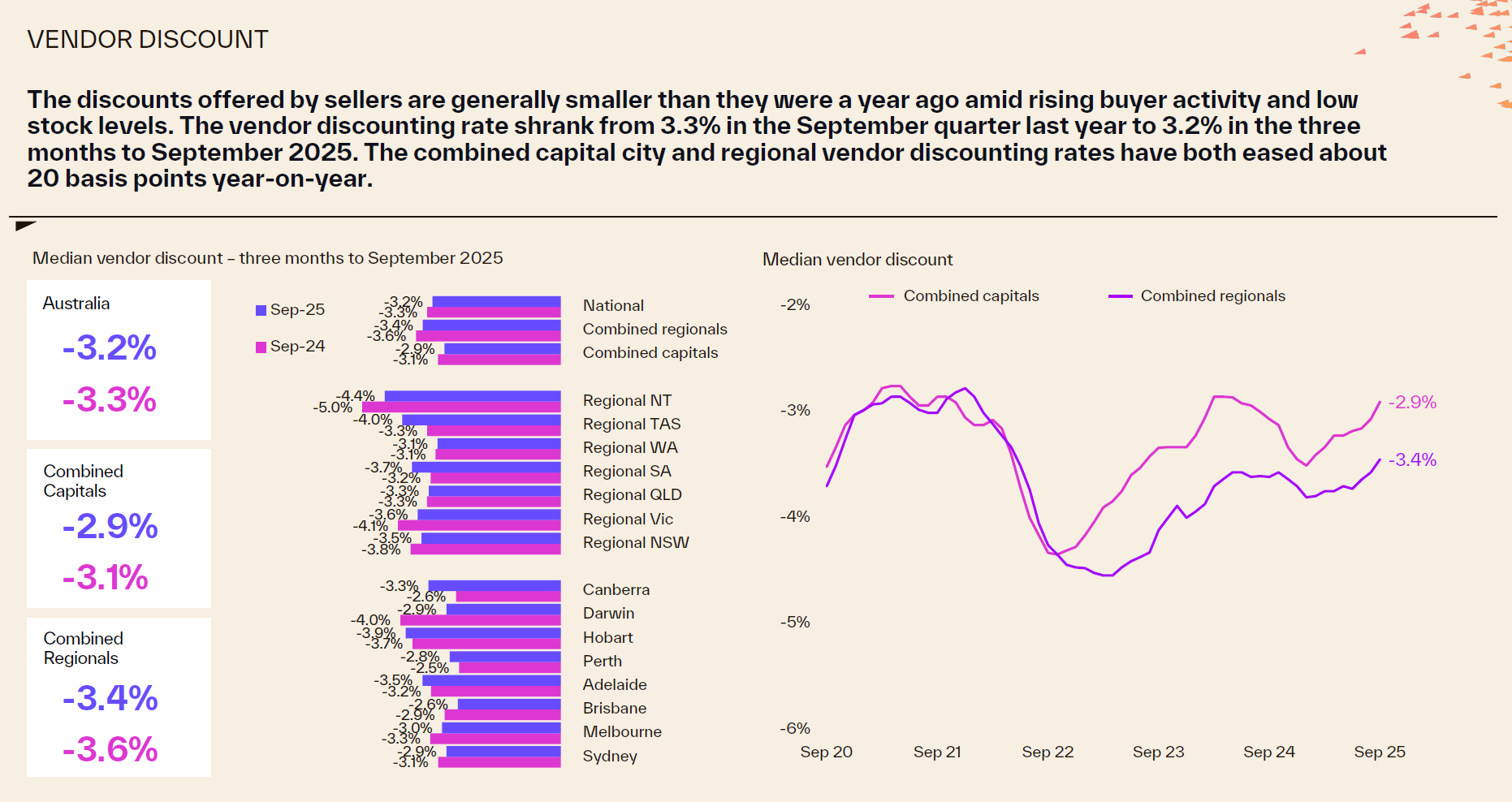

Faster Market Pace:

The vendor discounting rate tightened from 3.3% to 3.2% over the year, indicating stronger buyer competition and limited supply, giving sellers more pricing power.

Ongoing Supply Shortage:

Despite a lift in new listings in the four weeks to October 5, new supply remains 7.6% below last year’s level and 2.1% below the five-year average. Total housing stock is 19.3% below the five-year average, reflecting severe supply constraints.

Auction Market:

The combined capital cities’ clearance rate continued to improve, reaching 69.8% in the four weeks to September 28, up from 61.8% a year earlier — signalling better selling conditions.3. Rental and Credit Market Dynamics

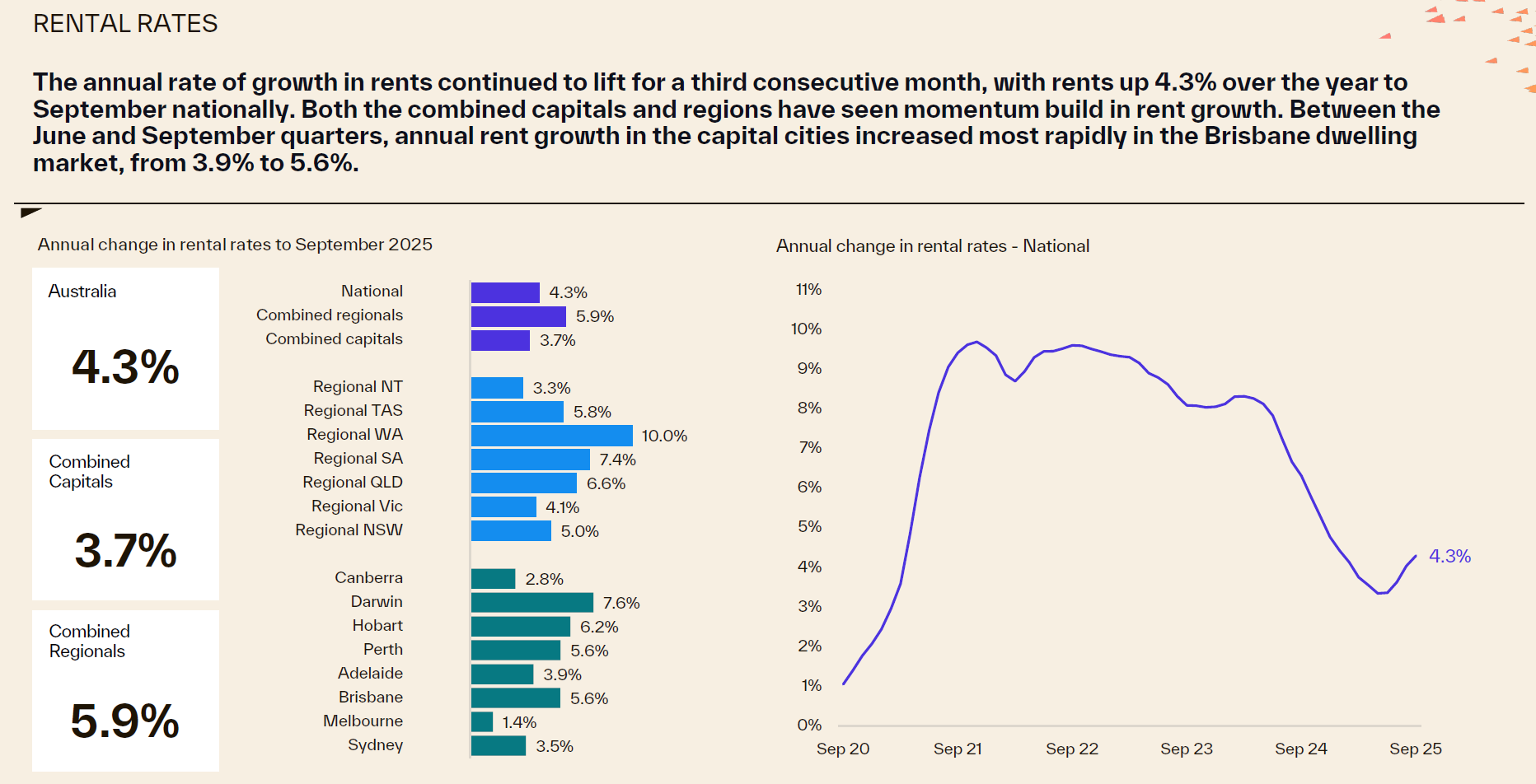

Rent Growth:

National rents grew 4.3% over the year to September, with capital cities (+5.9%) and regional areas (+3.7%) both showing accelerating trends.

RBA Policy:

At its September meeting, the Reserve Bank of Australia (RBA) kept the cash rate at 3.60%.

The accompanying statement struck a more hawkish tone, highlighting slower disinflation and resilient domestic data, leading markets to lower expectations of a November rate cut.

Loan Demand:

Despite tighter rate expectations, housing credit demand continued to rise.

In the June quarter, the total value of new housing loan commitments increased 2.0%, driven mainly by investors, whose loan volumes grew 3.5% quarter-on-quarter.

Investors accounted for 37.7% of total loan value — above the historical average.

Housing Construction:

In August, dwelling approvals fell 6.0%, including a 10.6% drop in apartment approvals.

New dwelling approvals have been below the 10-year average in seven of the past eight months, signalling continued pressure on future housing supply.Summary

To summarize, housing prices are still rising, but it depends on the specific region and property type. Landlords' pricing power (or premium) is increasing, but they don't have complete control over the market. Although the expectation for a mortgage rate cut in November has weakened, loan demand is growing. Therefore, overall, now is still a good time to buy a house.

Don't miss out if you're looking to buy a home!Report Link: https://www.cotality.com/au/resources/downloads/monthly-housing-chart-pack

All charts are from Cotality <Monthly housing chart pack>

If you are considering applying for a loan, contact us for a free consultation, see how we could help you.