Australia’s Rate Cut Is Delayed

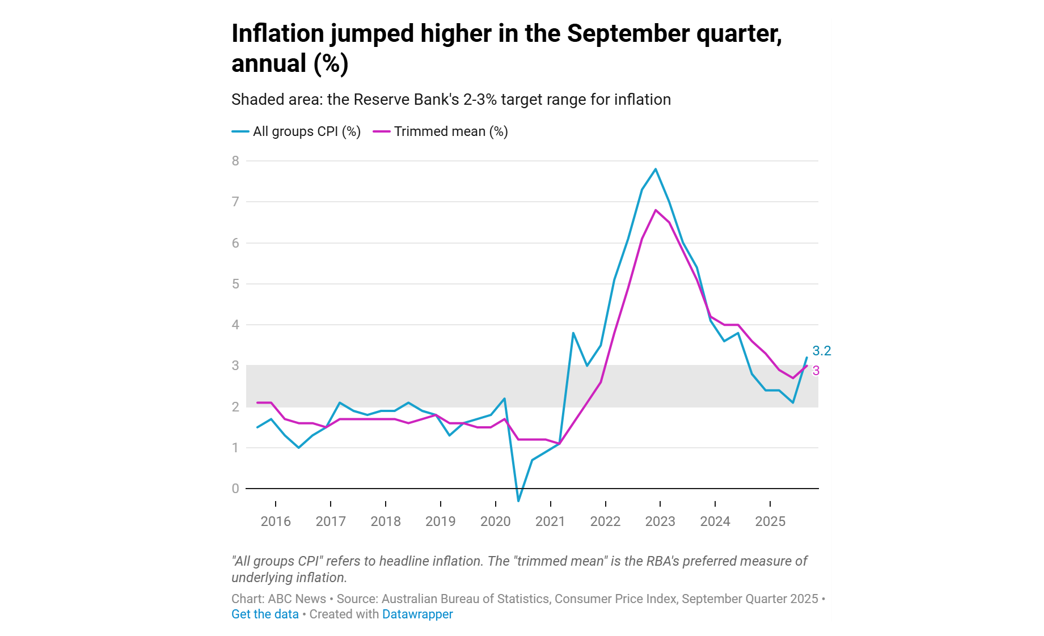

At its November meeting, the Reserve Bank of Australia (RBA) decided to keep the cash rate unchanged at 3.60%, signalling a cautious stance as inflation gradually eases while growth slows. Although rate cuts are unlikely in the short term, a medium-term easing remains highly probable.

Overall, the Australian economy is navigating a phase of both opportunities and challenges. The labour market has softened slightly but remains stable; inflation is moderating; household sentiment is improving; and the housing market is showing early signs of recovery.

For those considering buying, selling, or restructuring their mortgage, this period presents a critical window of opportunity. Although current rates remain elevated, market forecasts suggest a potential rate-cut cycle in 2026. Securing the right loan structure now can provide greater flexibility and financial advantage when rates eventually fall.

Mortgage stress has remained elevated despite RBA governor Michele Bullock announcing interest rate cuts in February, May and July. Picture: Christian Gilles

At the same time, property activity is rebounding. More buyers are returning to the market, lending conditions are stabilising, and credit availability has improved. For first-home buyers and investors, this represents an ideal moment to plan ahead and enter strategically.

Naturally, challenges remain. Inflation has yet to return to target, rising labour costs and weak productivity continue to weigh on outlook. However, policy signals suggest that the RBA has shifted from a “tightening bias” to a “wait-and-see stance”, keeping the door open for future easing.

In conclusion: Australia’s economy remains resilient, and the signs of market recovery are becoming clearer. For property owners and borrowers, now is the time to reassess strategies and prepare for the next easing cycle.If you are considering applying for a loan, contact us for a free consultation, see how we could help you.